On the 24th of February 2022, a full-scale Russian invasion of Ukraine began. The world was struck and this was also evident when looking at the capital markets which reacted very suddenly and there was a lot of volatility in the markets.

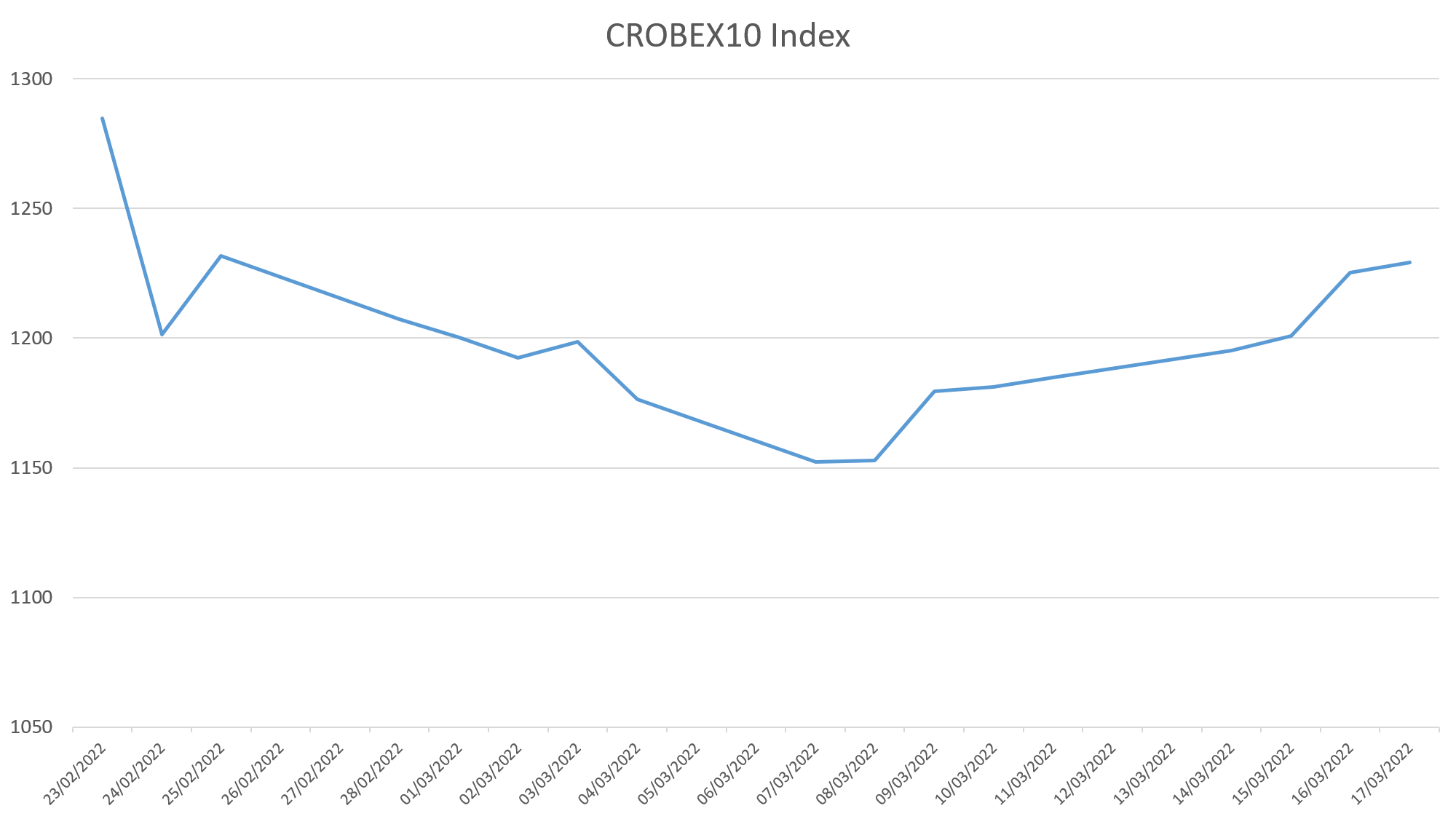

The Croatian equity market can be observed by looking at the benchmark index CROBEX10 which is made up of 10 Croatian blue-chip companies with the largest free-float, liquidity, and market capitalization. CROBEX10 fell by 6,47% on the first day of the invasion falling from 1284.56 to 1201.42. The downward trend has started even before that which is not odd since financial markets are to a large extent forward-looking. CROBEX10 reached its peak on 19th January at 1342.93 and has from there slipped down to 1152.36 on March 8th, cumulatively falling by 14,19%, and technically speaking entering into a correction phase. From March 8th to March 17th at the time of writing this article CROBEX10 has soared back up by 6,57% and it reached 1228.

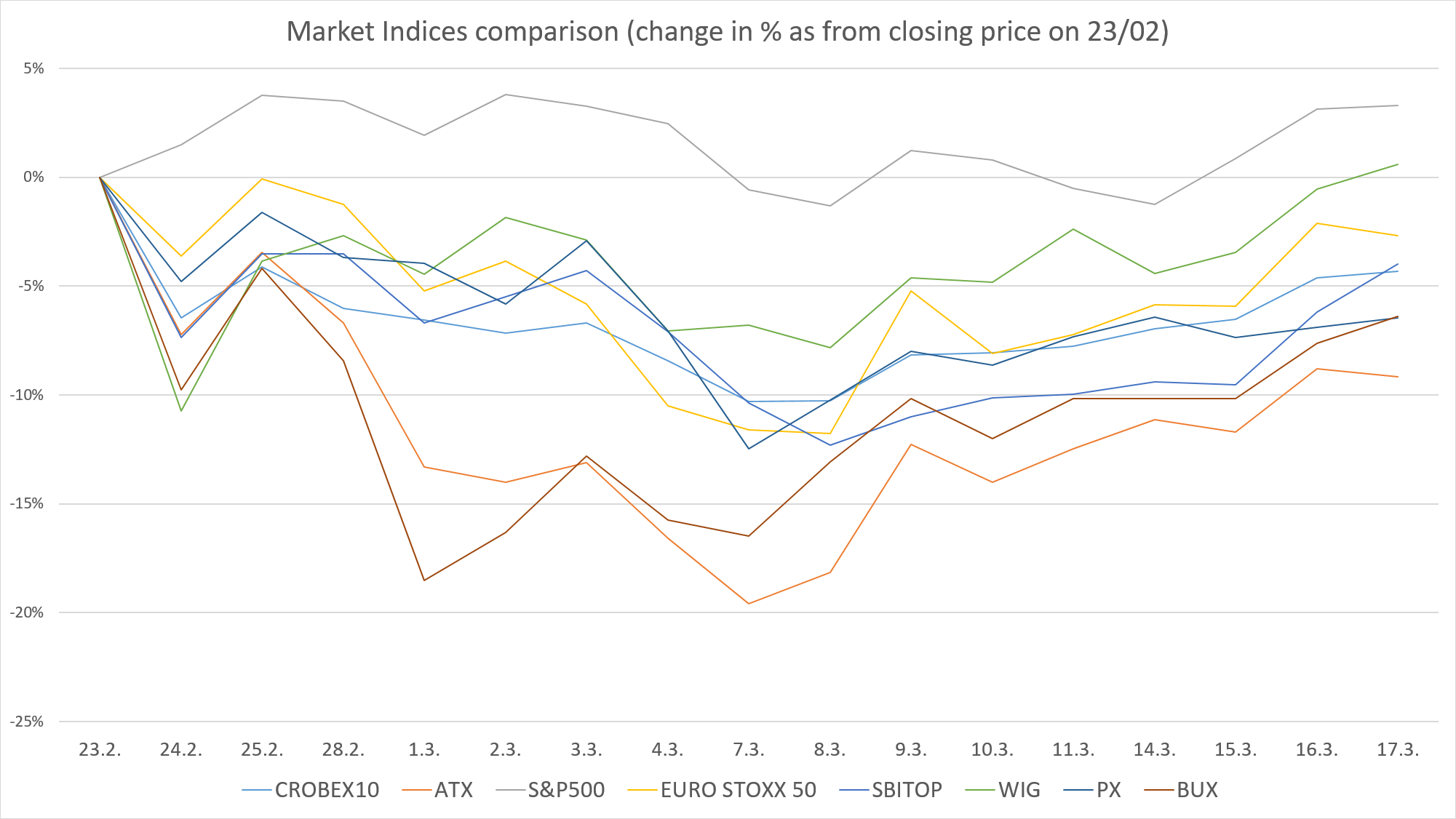

When comparing Croatian CROBEX10 with other European and American market indices we can see that some Indices experienced an even more drastic market sell-off. Most notably Polish WIG fell by 11%, Hungarian BUX fell by 10%, and Slovenian SBITOP and Austrian ATX dropped 7% on the first day of the invasion.

Some of these indices have managed to return near the price levels as before the war while others are still deep in the red zone. As of 17th of March, Austrian ATX is at -9%, Cezch PX and Hungarian BUX at -6% while Croatian CROBEX10 is at -4% compared to their price levels on the 23rd of February.

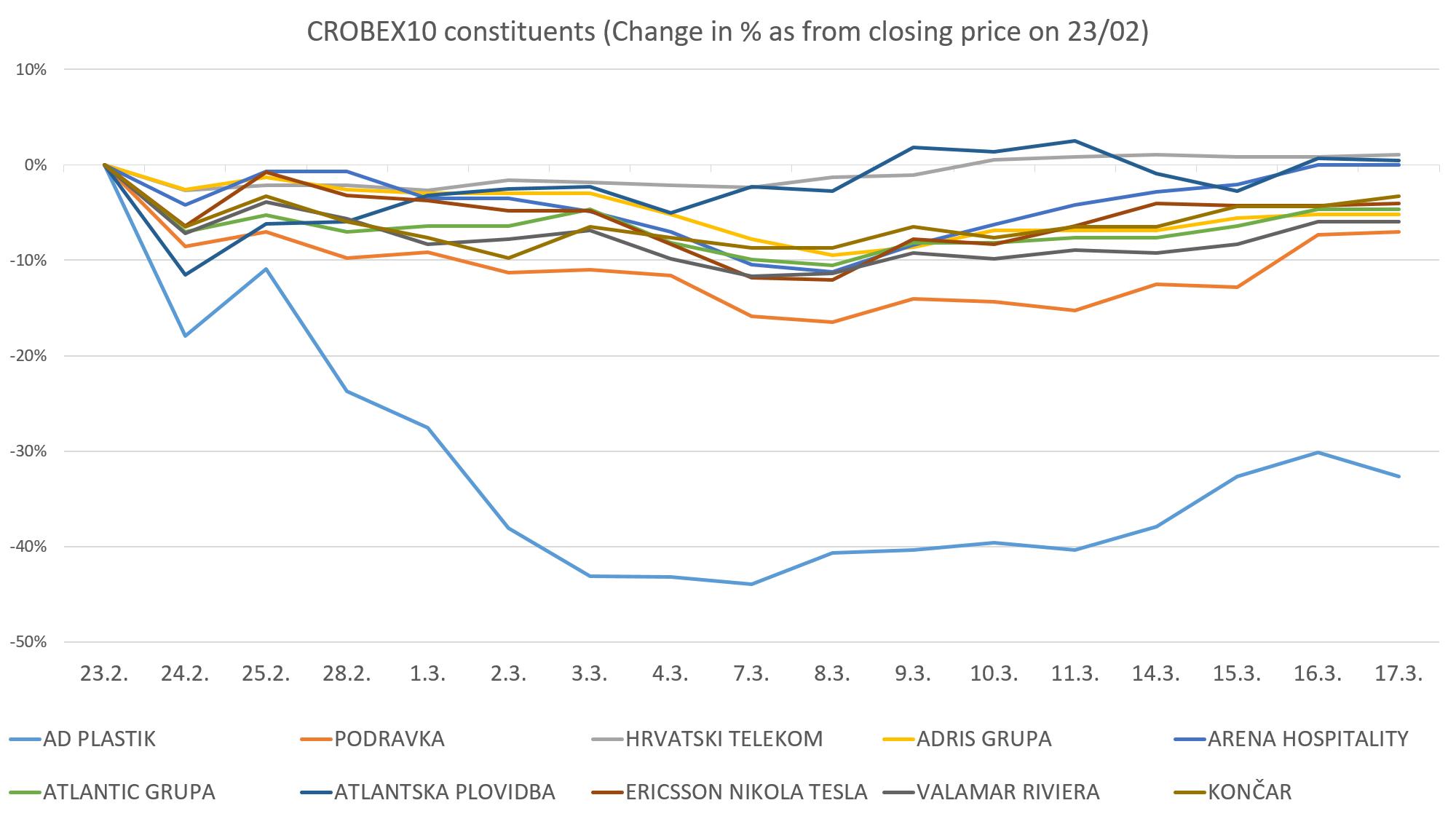

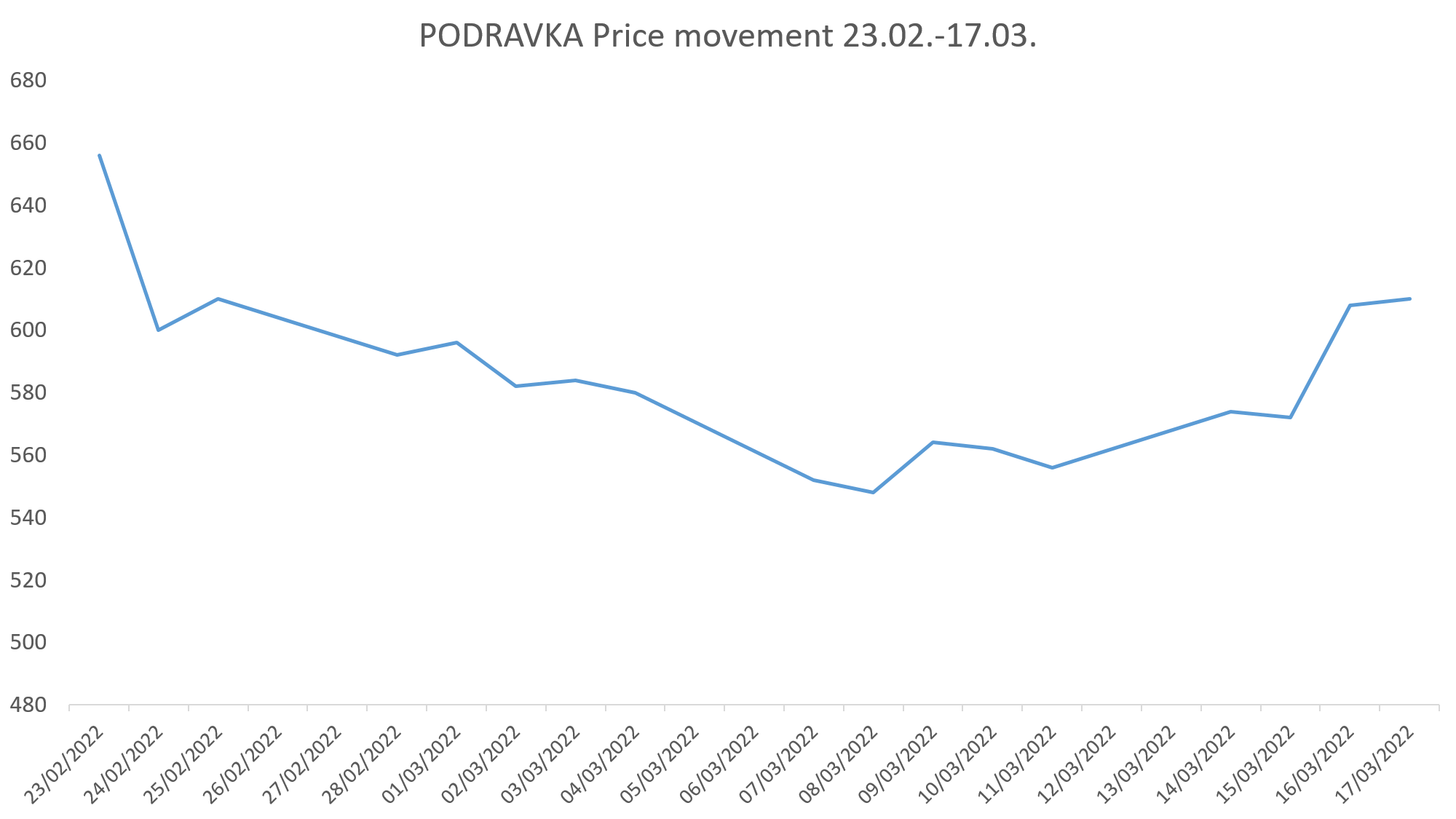

When looking at CROBEX10 and its 10 constituents we can see that on the first day of the invasion the biggest drop can be seen in Ad Plastik -18%, Atlantska Plovidba -12%, and Podravka -9%.

It is interesting to see how the market reacts to an unpredictable event such as this war and it is the best indicator of the extent of exposure these companies have to Russian and Ukrainian markets. As of the 17th of March, most of these companies are near the price levels before the war. Two companies that made an official statement to ZSE and which are clearly exposed to these markets are AD Plastik and Podravka which is also seen in their price level which is currently -33% and -7% respectively, compared to the price levels before the escalation.

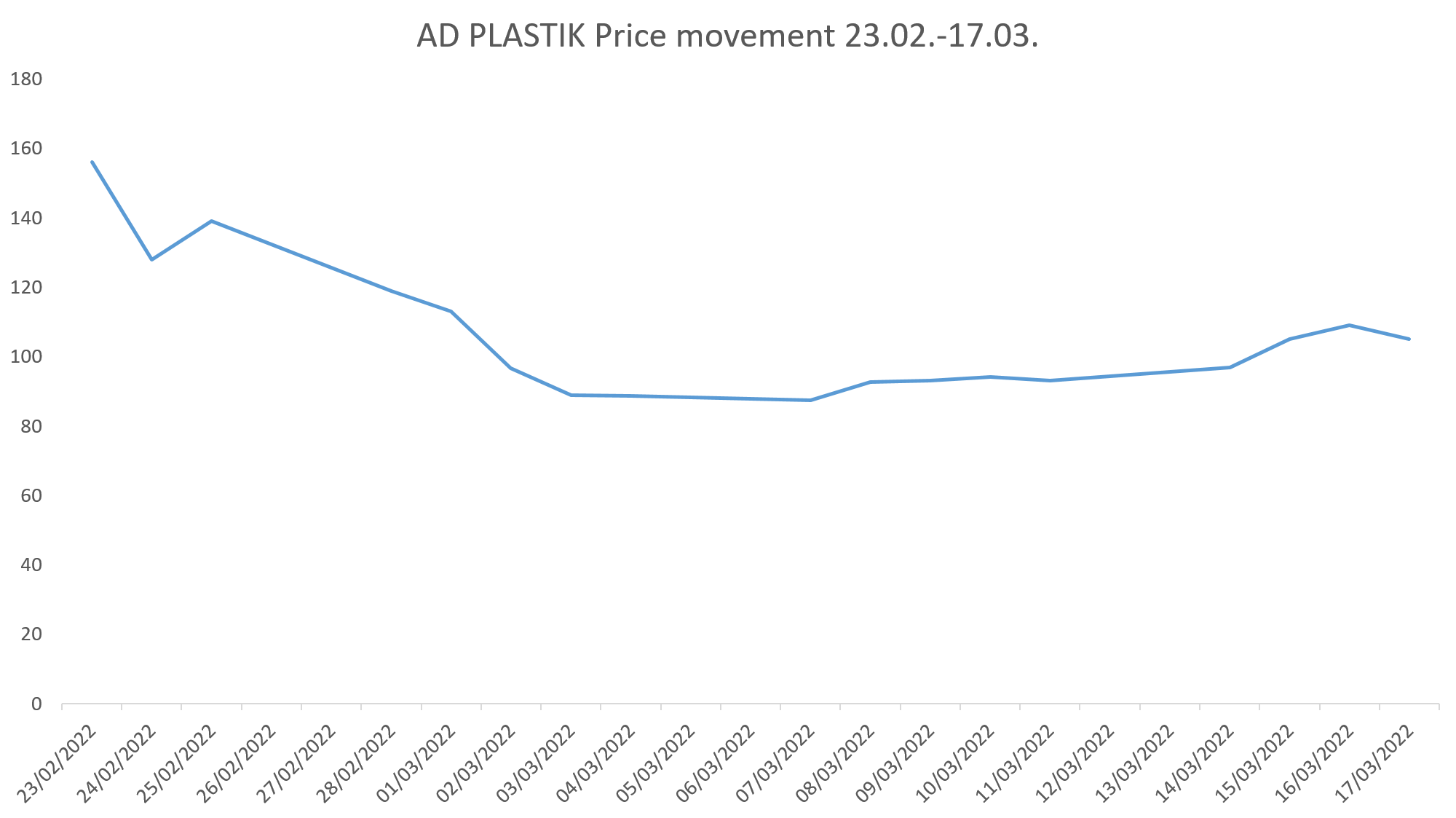

AD PLASTIK

AD Plastik is a Solin-based manufacturer of automobile components. Unfortunately, AD PLASTIK is largely impacted by the Russian Ukrainian war. They have two factories in Russia which together account for around 25% of their revenue according to their statement published by ZSE. These two factories sell exclusively to the Russian market and through them, AD Plastik is exposed to the fluctuation of the Russian Rubble. The AD Plastik share price was falling from the start of the war on the 24th of February until March 7th falling by 44% and whipping out nearly 300 million HRK from their market capitalization. As of 17th March, its share price has scaled up to 105 HRK which is a 20% increase but it is still 33% lower than the share price before the start of the war.

The additional burden was the release of their 2021 financial statements on the 24th of February, which showed a drop in operating revenue by 6.8% and a drop in their EBITDA margin by 273 bps. This is most likely caused by the chip shortage and other supply chain problems in the automobile industry.

On a positive note, on March 9th, they made a public statement announcing a new contract with Stellantis Group and Motherson Group for the European market which are together worth 73,6 million Euros.

PODRAVKA

Podravka is Koprivnica based food and pharmaceutical company. According to their statement published on ZSE, the group’s exposure to Russian and Ukrainian markets account for less than 6.5% of their sales revenue. Belupo, their pharma division, had 37,1% of international sales in Russia according to their 2020 annual report. Considering that their pharma division had significantly higher EBITDA margins In 2021 with 20.5% compared to 10.6% in the food division, it Is likely that investors expect a decrease in EBITDA margins in the coming period.

On the positive side, their 2021 financial report recorded a 2.8% increase in the group’s sales revenue and a 64 bps increase In their EBITDA margin.

To conclude, the Croatian equity market has been through a few turbulent weeks and has managed to partially recover but we are still surrounded by a high level of uncertainty, with the war in Ukraine still raging, with rising inflation, and the upcoming interest rate hikes it will be a challenge for the whole world and especially for the European continent.

Disclosure: I do not own any of these shares and this article is purely for informational purposes and should not be used as the basis for any investment decisions.

SYMBOLS

EBITDA – earnings before interest taxes depreciation and amortization

WIG – Warsaw Stock Exchange General Index (WIG)

BUX -Budapest Stock Exchange Index

SBITOP – Ljubljana Stock Exchange Index

ATX – Austrian Traded Index

PX- Prague Stock Exchange Index

S&P500 – Standard and Poor’s 500 Index

EURO STOXX 50 – stock index of Eurozone stocks

CROBEX- Zagreb Stock Exchange Index

Sources: zse.hr , pse.cz , RGFI , marketwatch.com , wienerborse.at, ljse.si

For more, check out our business section.