July 28, 2019 – The conflicting messages from official statistics and private renters in Split have caused some discussion. Is it already leading to the market correcting itself?

One of the destinations which is offering a very different picture of the tourist season is Split. While official statistics point to a record year, many apartment owners are complaining of empty beds in peak season.

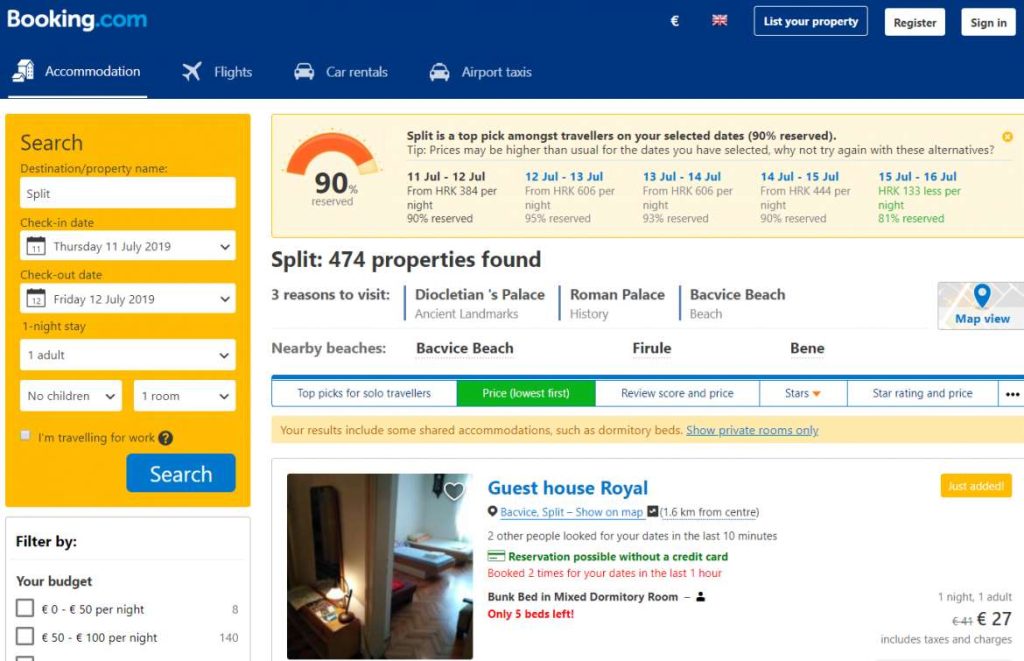

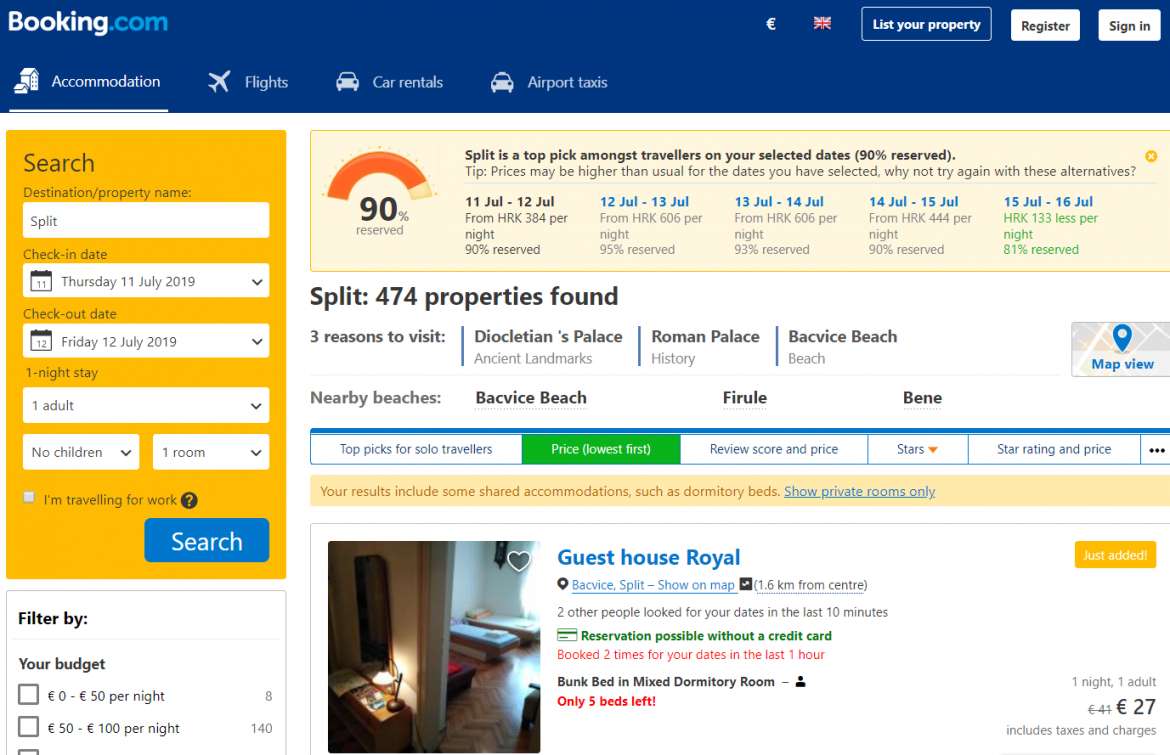

As I explained in a previous article, each year I check out the price and availability of accommodation on the first night of the Ultra Europe Festival. If you are not full during Ultra in July in the middle of the peak season, when will you be?

In 2013, the first year of the festival, there were just two options left in the city, the cheapest of which was 200 euro a night. Last year, there were 441, cheapest price 27 euro. And, as you can see above, this year, there 474, also starting at 27 euro.

With Split feeling pretty full, there was only one explanation for the empty apartments – oversupply.

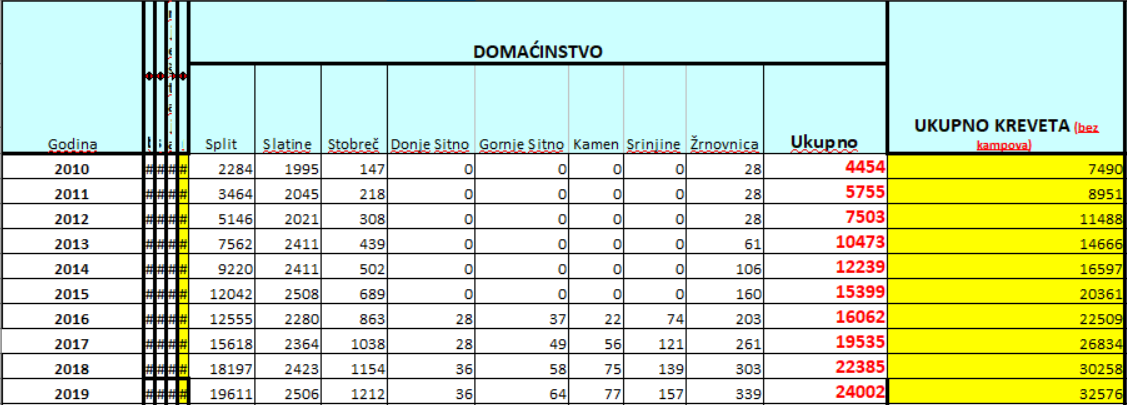

Just how much of an oversupply was about to come from official statistics I obtained from the Split Tourist Board:

There you had it. In just 9 years, the number of beds in private accommodation had risen fro 4,454 to 24,002.

While the Ministry of Tourism is restricting access to official statistics, some destinations are not afraid to publish their July numbers. Vir is having a record season, and the only other big destination which has transparently published the data is Split. Split is also having a great season and has also given a great breakdown of the various types of accommodation in the city, and the hotels are full. You can see their press release here.

So with a lot of oversupply with apartment rentals, what to do?

I met a friend for a beer in Split the other day who follows such things closely. He himself rents a 90m2 apartment in the centre year-round for 700 euro a month. It is a great arrangement. He loves the apartment and has a secure tenancy, and the owner has a guaranteed income of 8,400 euro a year gross and doesn’t have to think of any advertising, booking or property management costs or effort.

Finding a long-term 12-month rental is becoming increasingly difficult in the bigger top destinations on the coast. It used to be common to rent to students during the academic year, then to tourists in the lucrative summer months. But as the season got longer, so the students could not compete with the tourist short-term rental prices.

My friend has noticed in recent days that more long-term rentals are being advertised in places like Njuskalo, as perhaps people are having a rethink due to the oversupply.

He understands this subject better than me, but argued that to make the 8400 a year from a simple long-term rental, you would need to earn somewhere near 15,000 a year from the same rental, once advertising, booking and property management costs were taken into account. If the apartment cost 100 euro a night, he argued, one would need 150 nights to get to the same earning for the long-term rental. And if there are 474 apartments available on the first night of Ultra, who can guarantee that?

And so will it happen that the oversupply will force some owners to be realistic about their tourism income potential, especially if they have nothing special to offer, and to return to the security of long-term rentals? I think that will happen and, with several new hotels set to open next year in the Dalmatian capital, and with quality private accommodation looking strong, I think that market forces will push the Split accommodation balance the right direction. It should lead to more affordable housing and more locals renting close to the centre, which is a good thing, of course.

What are your thoughts?

To learn more about the city, check out the Total Croatia Split in a Page guide.