With an expected number of 86 million overnight stays and EUR 9.5 billion in tourist revenue, Croatia is still far from destinations such as France, Spain, Italy and Greece, but high rates of growth show that we are on the right track.

On August 7, 2017, Tportal made a short analysis of Croatian tourism that reveals what is behind the record figures that we are daily bombarded with by the media. Take a look at how successful we really are, how we compare to our competitors and how much we have done in relation to some ambitious strategic goals.

There is no doubt that there has been a boom in Croatian tourism in the past years. This can be seen in two-digit turnover and revenue growth rate, but also in higher quality of services. New records have been broken this year – in July, there were more than a million overnight stays per day in the Adriatic.

In the first seven months of 2017, the number of arrivals increased by 17 percent and the number of overnight stays increased by 16 percent. The minimal expected growth of the main indicators in 2017 is 10 percent, which means that the revenue from foreign tourists will probably exceed EUR 9 billion. If we add revenue from domestic tourists to the equation, the financial turnover reaches EUR 11 billion.

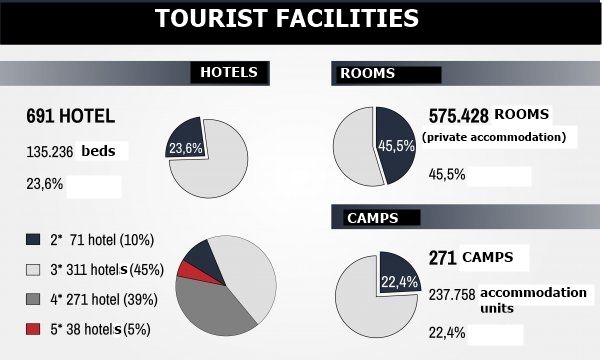

In recent years, leading hotel groups have launched a series of investment that have led to raising accommodation quality and increasing the number of four and five-star hotels. Modernization has brought on higher standards and numerous additional services that are appealing to demanding tourists.

In 2017, the investments in tourism are estimated to reach EUR 800 million, and about forty new and renovated hotels are expected to open. Some of the biggest investments include the Olympia Sky Hotel in Vodice, Valamar’s two summer resorts in Rabac and the renovated Hotel Excelsior in Dubrovnik.

However, the highest share in the revenue is still being produced in the private accommodation sector. Many private renters have improved their level of service considerably, but this segment is still extremely seasonal and brings low profit.

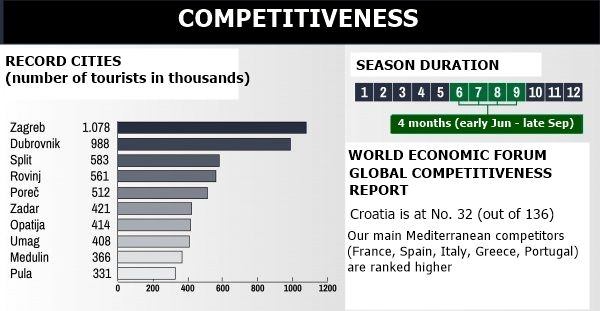

Croatia ranks 32 out of 136 countries in the World Economic Forum’s Global Competitiveness Report. With an average score of 4.4, Croatia has climbed up from No. 35 to the respectable No. 32.

Although Croatia’s ranking is good, the main competitors in the Mediterranean rank higher. Spain and France are No. 1 and 2 on the list, and Italy is among the top ten. Portugal is No. 14, and our biggest competitor, Greece is No. 24.

According to CNB data, with EUR 8.54 billion in foreign currency revenues, tourism has reached 18.9 percent of the country’s GDP. As its share in the GDP keeps growing, it could reach 20 percent in 2017.

An increase in tourism revenue is certainly encouraging, but the increase in the share of tourism in GDP also has some negative implications. Tourism’s huge share in the Croatian GDP points to a high degree of economic dependency on this sector, which is low profitable in nature and brings less added value than most other entrepreneurial activities.

In developed countries, tourism is generally a secondary activity and its impact on GDP is far lower than it is in Croatia. Let’s take the USA as an example – foreign currency income from tourism accounts for only one percent of the GDP, and in the European Union, it is about 2.3 percent.

Experts emphasize that Croatia has not yet taken full advantage of its tourist potential because it has not managed to significantly extend the tourist season. Only in few top destinations (Zagreb, Dubrovnik, Rovinj, Poreč) are there prerequisites for the development of year-round tourism, while in most Adriatic destinations, the season lasts a maximum of four months.

As a result, this sector does not, on average, make an adequate return on investment, especially when it comes to private accommodation. Another problem is the fact that local businesses dealing with food and wood industry are not sufficiently included in tourism.

Even though the results achieved over the past few years are encouraging, they are still below the ambitious goals set out by the Tourism Development Strategy until 2020. Therefore, implementation performance monitoring of the measures identified by the strategy outlined by the State Audit Office in 2016 has shown that most of the goals have not been achieved.

Among other things, audit findings have shown that, instead of the desired growth in the number of hotel rooms, the number of beds in private accommodation has increased, and investments and tourist expenditure are growing far slower than expected.

Text and charts translated from Tportal.hr.