This is the first postponement in the history of Croatia and it seems that political instability is to blame.

Representatives of the Croatian Ministry of Finance and the Croatian National Bank were in Germany and the UK this week meeting with investors where they had their chance to present the basic macro-economical indicators and trends, reform programme and the country’s fiscal and monetary policies, however, it seems that the news of political instability and possible fall of the current government has reached the investors causing their distrust, Index reports on June 1, 2016.

“Reaction of the investors was very positive, but it was decided that we should continue monitoring the situation on international markets and that we should hold off with the publishing of the only planned round of Eurobonds this year until all political uncertainties are settled” the press release from the Ministry of Finance states.

This is nothing new to anyone who is closely following the international market since rating agencies have warned investors of possible political instability months ago.

Back in March, Moody’s Investors Service has today downgraded Croatia’s long-term issuer and senior unsecured debt ratings to Ba2 from Ba1 and maintained the negative outlook. Furthermore, Croatia’s long-term and short-term foreign-currency bond ceilings were lowered to Baa3/P-3 from Baa1/P-2, the long-term foreign-currency deposit ceiling was lowered to Ba3 from Ba2. The short-term foreign-currency deposit ceiling remained unchanged at Not Prime (NP). At the same time, the local-currency bond and deposit country ceilings were lowered to Baa1 from A3.

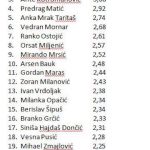

In their explanation of the downgrade, Moody’s noted that the current coalition in parliament between the Patriotic Coalition and MOST holds only a slim majority, especially following the latter’s loss of four MPs. The wide range of political views within the coalition and the relative inexperience of MOST’s MPs at the central government level increase the risk that the new government will be unable to sustain majority support in parliament for economic and fiscal reforms. While the new government has popular support for reforms as MOST campaigned on a pro-reform platform, some of the proposed reforms (such as the rationalization of the public administration) already face resistance from different parts of the coalition.

Less than three months later is seems that Moody’s was spot on with the prediction and it remains to be seen whether this government can turn things around and do the one thing former government failed – win back the trust of investors and turn around the bleak economic outlook.