Camping tourism in Croatia has not received much attention throughout the years, but its significance as part of Croatia’s tourism offer cannot be neglected. The history of camping in Croatia dates back to 1934, when the first unofficial naturist camp was opened on the island Rab in Yugoslavia. In the beginning, camping in Croatia was closely related to naturism tourism. In 1953, there were 18 camps in Yugoslavia, and half of those were located in Croatia. Back then, 70% of tourists were domestic tourists from Yugoslavia, which shows that camping was very appealing for the local population in this early stage.

As the years went by, the camping industry evolved, and in 2019, which was a record-breaking year, it accounted for 2,9 million tourist arrivals and 19 million tourist nights in Croatia. Camping as a tourism sector or as an accommodation type includes camping sites, small camps, quick stops, in both private facilities, and households and family farms. Camping holds the second position in the number of permanent beds by accommodation type with 20,4%, while objects in households hold first place with 49.6%. However, it should be noted that beds in camps are not just actual beds but also include beds that can be brought to the camp by tourists in the form of a tent or caravan. Therefore, when looking at tourist arrivals, we can see that Camping as a category is usually in the third place. On the other hand, Hotels and Camping generally fight for second place when observing tourist nights, with camping being third in 2019 and second in 2021.

Camping has a higher average length of stay than hotels and objects in households. For example, in 2021, the average length of stay in camping was 6.7 days compared to objects in households (6.5 days) and hotels (3.8 days). This is why camping’s relative proportion of tourist arrivals is smaller than the proportion of tourist nights. What is more, when looking at 2021, we can see that Camping experienced the fastest comeback, reaching 88% and 91% of tourist arrivals and nights respectively, as compared to the all-time high in 2019. For comparison, all types of accommodation (not including nautical and non-commercial accommodation) have reached 66% and 78% of tourist arrivals and nights, respectively. This can be interpreted by the resilience of camping as a touristic sector in the context of the current pandemic. Additionally, it can also be a sign of growth in this sector, which Croatia should be ready to exploit to its advantage.

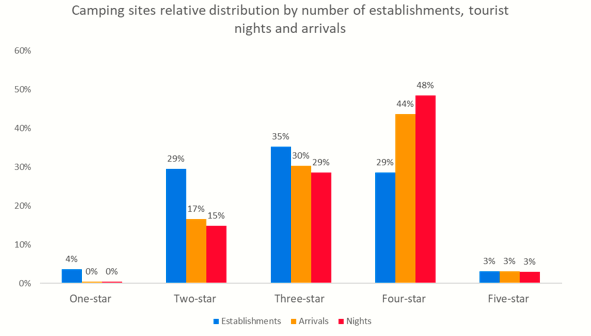

In 2019, 346 camping sites and camping grounds were established according to the NKD classification. These establishments had a combined number of 258 rooms, 141 apartments, and 93,513 camping grounds. Out of these 346, there are 224 camping sites observed according to several stars, similarly as hotels are categorized.

Camping sites accounted for 94% of arrivals and 95% of tourist nights in the total camping accommodation category. We can observe that camping sites with 2, 3, and 4 stars dominate this sector from the table above. Interestingly, four-star campsites account for 29% of all campsites but 44% and 48% of tourist arrivals and nights, respectively. This can be interpreted in a way that camping tourists are looking for higher quality services and are willing to pay for them.

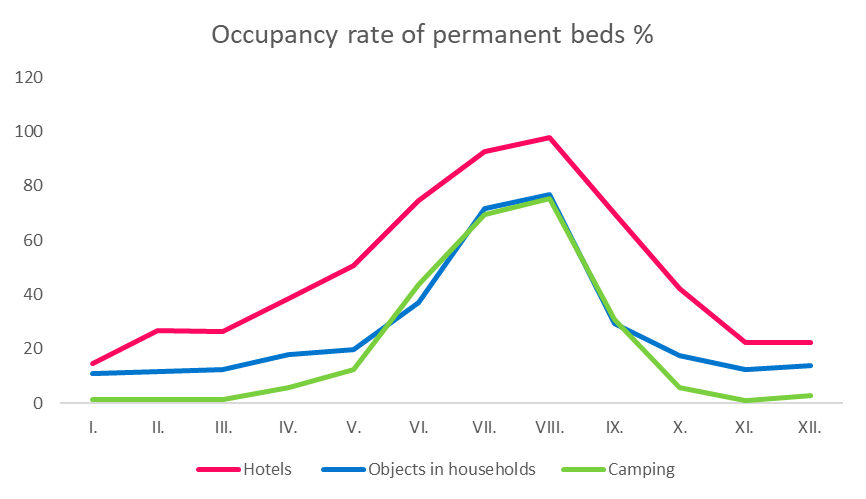

The occupancy rate of permanent beds, measured monthly, shows us that Camping has a similar occupancy rate as objects in households but with a greater seasonality effect. Seasonal character is more or less expected since camping involves spending a lot of time in the open. Hence, it is very dependent on weather factors and the outside temperature. The occupancy rate of permanent beds should be taken with a grain of salt since the methodology of counting permanent beds is very specific in the case of camping when compared to other categories.

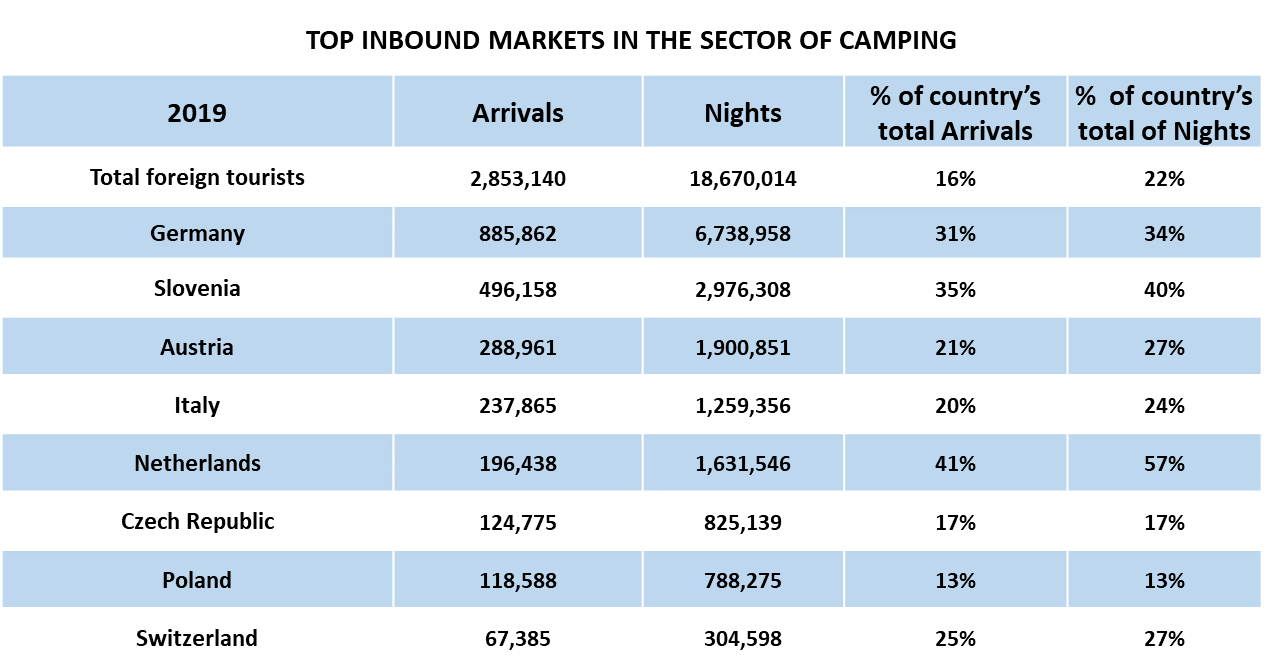

Camping tourists are predominantly foreign tourists, with foreign tourists accounting for around 97% of both tourist arrivals and nights. This is also considerably higher than other categories: Hotels (85%, 89%) and objects in households (92%, 93%). In the table below, we can observe which countries accounted for the biggest share of tourist arrivals and nights in camping.

Germany, Slovenia, Austria, and Italy cumulatively account for approximately 70% of all tourist nights and arrivals in camping accommodation units. Interestingly, one-third of all German and Slovenian tourists spend their holiday in Croatian camps. Dutch tourists account for the highest percentage, with 40% of arrivals and more than half of tourist nights are spent in camps.

Types of resorts and regional distribution

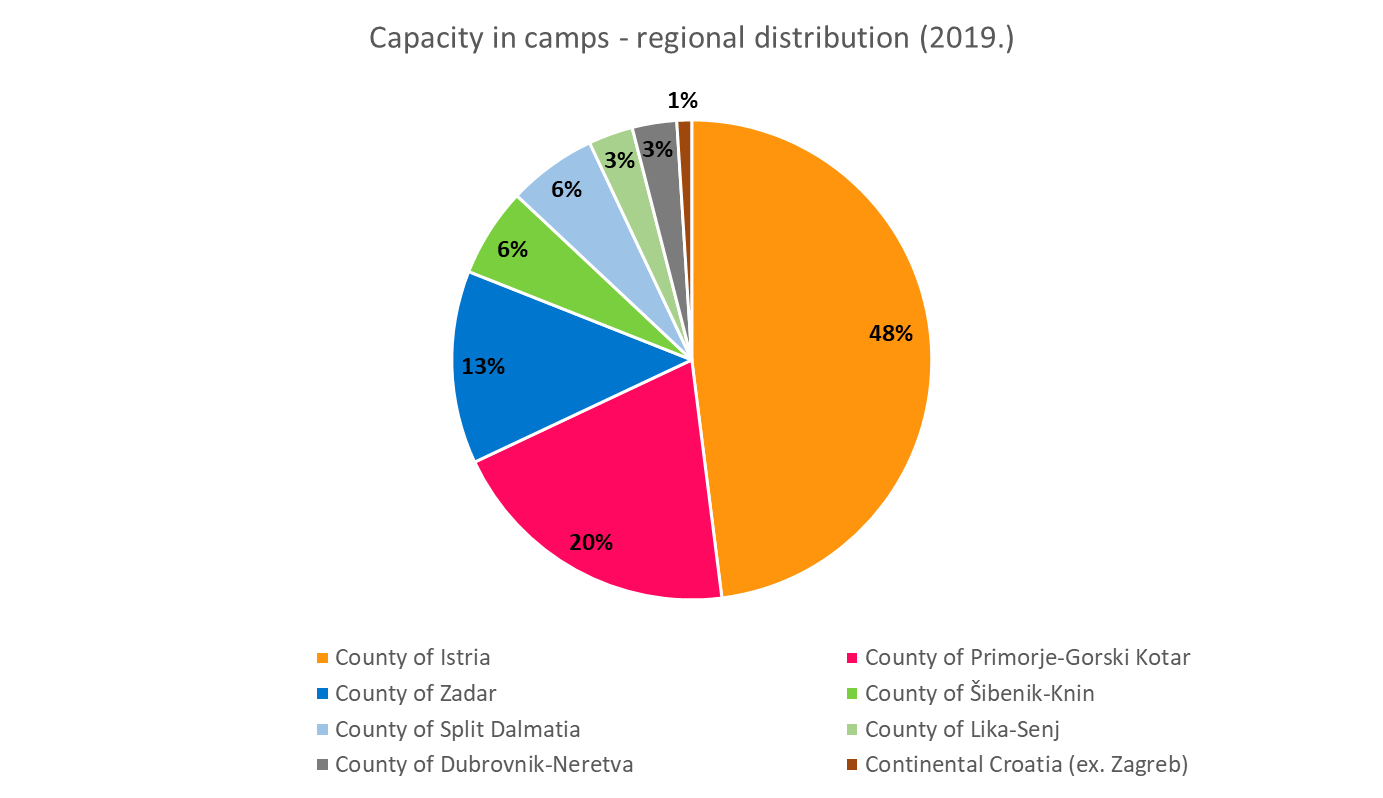

According to DZS, resorts can be divided into four categories: Zagreb, Thermal, Seaside, Highland and mountain, and Other resorts. In 2019, Seaside resorts accounted for 95% of arrivals and 98% of tourist nights. We see a distinctive concentration of camps in the northern part of the Adriatic region when looking at counties. Istria and Primorsko-Gorski Kotar county has the highest concentration of camps, cumulatively accounting for 68% of all camping capacity.

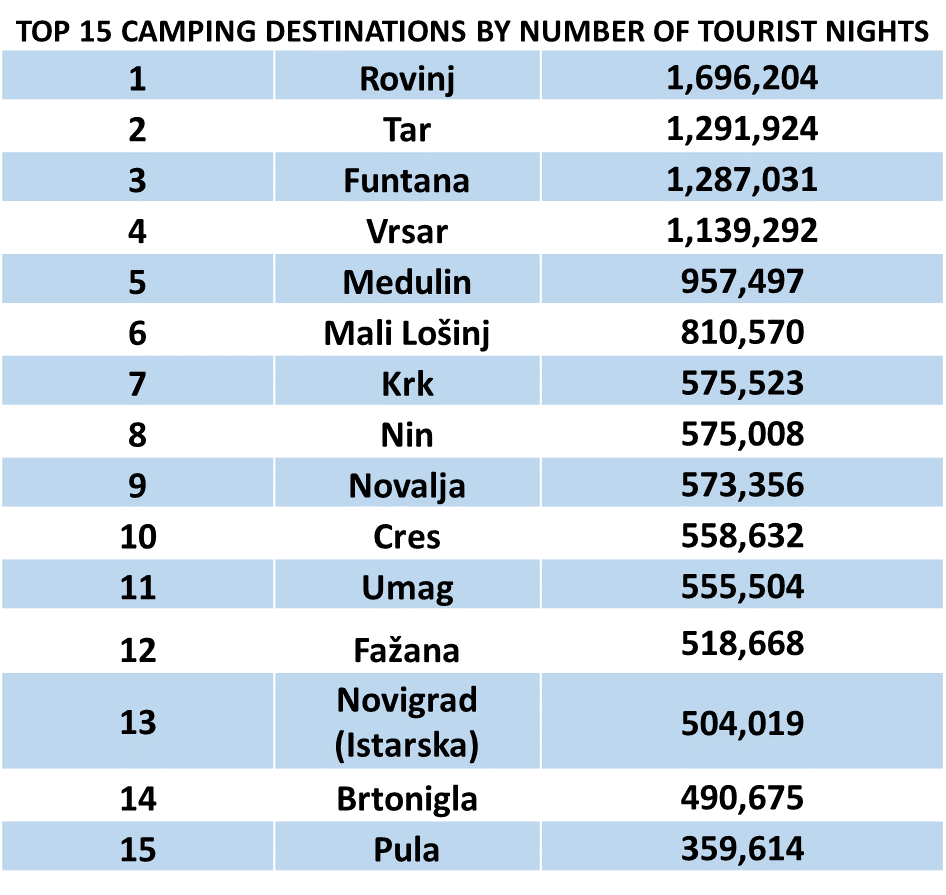

The list of top 15 destinations by the number of tourist nights confirms the extremely high concentration of camping establishments in the northern Adriatic regions.

The list of top 15 destinations by the number of tourist nights confirms the extremely high concentration of camping establishments in the northern Adriatic regions.

TOMAS – research

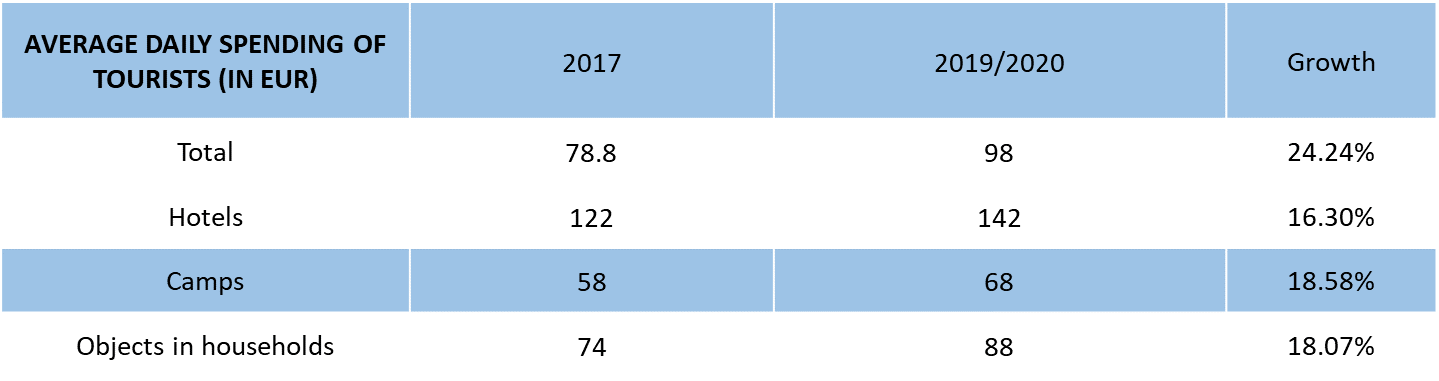

From the TOMAS research of attitudes and consumption of tourists in Croatia, which was conducted from 2017 – 2020, we can derive powerful insight into the characteristics of camper tourists. Campers and caravans are the third biggest mode of transportation with 11.4%, lagging behind cars 60% and airplanes 20%. Compared to other types of accommodation, Camper tourists are to a larger extent motivated by natural beauties and sport & recreation. Additionally, they are characterized as more loyal guests, with several repeated visits being substantially larger on average compared to other types of accommodation. Campers spend more time than an average tourist swimming and playing water sports but are less interested in sightseeing and gastronomy. The average daily spend of a camper tourist is on average lower than other tourists, both in 2017 and in 2019/2020. In this period, camping tourists have experienced the slightly largest increase of all observed tourists by accommodation type.

From 2009 to 2019, the number of camping facilities grew by 49% and permanent beds by 28%. For comparison, the number of hotel facilities increased 87%, and their permanent beds grew by 68%. At the same time, the number of facilities and number of permanent beds in the category of objects in households increased by an astonishing 1134% and 2019%, respectively. We can see that objects in households dominate, which is expected considering the rising trend of private accommodation and lower capital investments characteristic of this accommodation category.

Camping has a long tradition in Croatia, and its development will undoubtedly continue in the future. However, camping is the most underrated category out of the three most essential accommodation categories. It could be argued that the underdevelopment of camping infrastructure in some parts of Croatia is why Croatia has not yet realised camping’s full potential. The Northern Adriatic region is leading the development in this accommodation category. Time will tell whether or not the southern parts of the Adriatic region and continental Croatia will join in.

Data mentioned in this article is derived from the statistical reports, databases, and other resources from HTZ and DZS.

Additionally, some information has been used from the paper Kamping u Republici Hrvatskoj, Gordić Vedrana.

For more on travel in Croatia, follow TCN’s dedicated page.